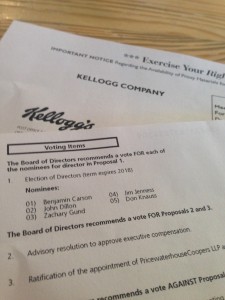

A new dilemma arose today in the ‘Teach my 9 year old child about money’ project. Kellogg’s sent her a voting card and ballot proxy, urging her to exercise her right to suffrage at the annual shareholder’s meeting, or more preferably, by signing a proxy form and sending it back to management.

She has that voting right because I am a mean daddy and I took her tooth fairy money and made her buy 8 shares of K back in 2013.

The ballot, like all the others I’ve ever gotten from public companies, urges her to:

1. Vote for the nominated slate of directors (about whom she knows nothing, obviously.)

2. Vote for the proposed executive compensation package (about which she knows nothing, but which I’m certain would be upsetting if she connected the dots for example about what they’re paid vs. what the parents of kids in her school make per year.)

3. Vote for the proposed annual auditor. (She’s only nine, but she’s actually dedicated quite a lot of time to understanding the differences between the Big 4 accounting firms, specifically as they provide services to food conglomerates, so I know she’d have a lot to say about this one. Like every kid I know, she just loves PriceWaterhouse Coopers LLC. And who doesn’t?)

Ballot choices 1 and 2 in particular represent a kind of charade democracy whereby the supposed owners (shareholders) ratify key insider-decisions (leadership and pay) but without any freaking clue what they’re voting for. And since the interest of shareholders might diverge strongly from the company leadership when it comes to executive pay in particular, shareholder voting for public companies in this manner is about as legitimate as elections in Communist Russia. And personally I don’t like to participate in charades and farces. 1

Just imagine if we ran The World’s Greatest Democracy this way, and the Financial-Powers-That-Be got together and only presented two choices for president, a Bush and a Clinton. Ummm…. 2

So the ballot and proxy card present a dilemma because I don’t know how to explain this all to my daughter. One solution, which I haven’t pursued yet, would be to toss out the ballot. That’s what I do when these things arrive for me, because I have my standards and I WILL NOT PARTICIPATE IN FARCES (unless, you know, see footnote 1 again).

But since the ballot arrived for my daughter, I have the urge to initiate a ‘teaching moment.’

I’m not sure what I’m going to say, but here’s my stream of consciousness so far:

“These ballots are a farce and shareholder democracy does not exist. This ‘election’ is illegitimate, obviously, even though the purpose is to legitimize insider pay and interlocking board membership, despite a nod toward the idea of ‘independent directors.’ There have been movements, periodically, to strengthen the idea of shareholder voting. ‘Shareholder activism’ has existed in visible form at least since the 1930s, but rarely has any effect on management.

Some of the worst excesses of capitalism stem from the inability of shareholders to act as a real check on the powers of executive management and board members. For example:

1. Executive pay for public companies completely unmoored from any realistic value creation by the executive.

2. Incentives to pump up CEO pay through interlocking membership on ‘executive compensation’ committees of boards, and the consultants who pay them.

3. Incentives for audit/accounting firms to avoid rocking the financial-trickery boat in order to earn more lucrative consulting gigs from their clients. (I understand this has gotten less common following the demise of Enron in 2001 and its accounting firm Arther Anderson.)

Unless you become Carl Icahn or Daniel Loeb, don’t hold out any particular hope that your ‘voting rights’ as a shareholder mean anything. The fact that Icahn and Loeb and others share your interests and make unpleasant but shareholder-friendly demands of management, however, makes them a sort-of heroic class of shareholder. Mostly they should be applauded.”

What a lucky kid, she gets to receive a lecture like this. She’s going to love it.

Please see related posts:

Executive Pay with Equity Awards

Executive Compensation – The Yahoo Story

My daughter’s first stock investment

Post read (1792) times.

- Unless there’s a lot of cross-dressing and burlesque, in which case count me in. Because as my mother once told me, ‘cross-dressing is always fun!’ ↩

- What a shit sandwich. This is a total tangent but for fuck’s sake my country is embarrassing me with these two choices. Excuse me, Financial-Powers-That-Be, but this is waaaaay too obvious. Try not to let people see quite so much of the magic trick as you’re doing it. Make the voters believe in Democracy, even just a little bit. ↩