My finance book of the year recommendation is one that perfectly matches the 2021 markets moment: William Bernstein’s The Delusions of Crowds: Why People Go Mad in Groups.

Over and over again this year I found myself describing developments in financial markets that seem, frankly, nuts. All I’ve done this year, it seems, is write about wacky finance trends.

If Bernstein’s investing book The Four Pillars of Investing is an all-time finance classic, his 2021 book is utterly timely, anticipating a year of financial delusions.

In The Delusions of Crowds, Bernstein toggles between stories of financial delusions and religious delusions. Both types of madness depend on two common human frailties. One he describes as the “Asch Effect,” based on a social psychological experiment which showed how humans can be convinced of obviously wrong things by the social pressure to conform to the opinions of others. When the religious leader or the financial whiz says something is true, and enough people around us agree, we tend to agree, despite evidence to the contrary.

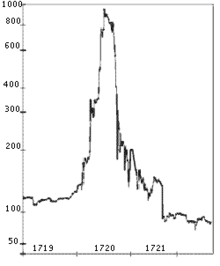

Another common thread is our ability as humans, in the face of contradictory evidence, to completely discount one set of facts if they conflict with our pre-existing beliefs. When the apocalypse does not arrive on the prophesized date, Bernstein notes, true believers do not necessarily reject the prophet. Insteaed, we listen eagerly for the prophet’s update on the next plausible date for the End of Times, rather than settle our cognitive dissonance through doubt or disbelief. Contradictory evidence is merely an opportunity to double-down on our fervent faith, not change our beliefs. The South Sea bubble, railroad stocks in 1840 Britain, the stock pools of 1929. The Fifth Monarchy of 1666, the seventh-day adventism of 1843, the Y2K mania. Bernstein does not mention the QAnon phenomenon, but clearly this recent movement falls within Bernstein’s historical pattern.

For those looking for a pure financial wisdom book, I should warn that Bernstein spends considerable time on non-financial matters. Specifically, he digs deep into the clear connection between “End Times” prophecies from past centuries and powerful Evangelical movements today. Bible-inspired numerology and prophecy has entranced people for a millennium. Bernstein makes the case that this madness not only follows historic patterns but also represents a current threat. Apocalyptic beliefs linked to what he terms dispensationalist Protestantism infuses our current politics.

Personally, I am somewhat immune to the Asch Effect. On the other hand, I tend to redouble my strongest views in the face of contrary evidence, often to my embarrassment. Which I will now demonstrate for you, in the course of reviewing the goofiest financial trends of 2021. Those trends, with caveats.

Meme Stocks

The Robinhood app and Reddit-Bro inspired investing in “Meme Stocks” like Hertz, GameStop and AMC kicked off in January 2021 with a bang. We should have known then that the entire year would be an unending string of delusions and madness. Most of these rockets have yet to fall to earth as the year ends, again not what I would have expected.

Caveat: Spotting undervalued companies unloved by institutional investors was the original plausible investment thesis behind some of these meme stocks. That’s cool but only accounted for the earliest movements toward stock appreciation, before the madness took over.

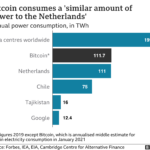

Cryptocurrency

These are closer to religion than financial bets or investments. The fundamental correct price of Bitcoin remains zero. That’s the same fundamental price as with all the other crypto currencies I’ve ever heard of. Anyway, hundreds of billions of smart investment capital disagree with me. Since approximately 2013, every time I talk to an audience of folks about investing the first question is always “should I/how can I invest in crypto?” My answer is always the same. Something to the effect of I would sooner recommend lighting one’s paper money on fire flying down the highway at 90 miles an hour. But again, I am clearly the idiot in the room. Up until now I have been wrong, wrong, and then wrong again about Bitcoin.

Caveat: I (kind of) understand blockchain technology might be the coolest tech since the invention of the selfie-stick. But cryptocurrencies are not the same as blockchain, and I will continue to disparage the former while being open to the future awesomeness of the latter.

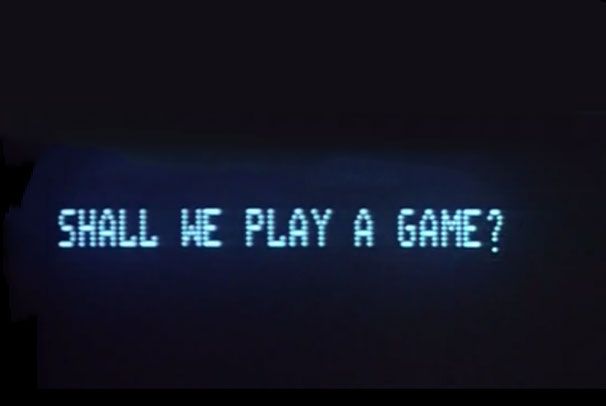

SPACs

Shall we all invest in an enterprise best described as “an undertaking of great advantage, but nobody to know what it is?” That was the infamous published description of a speculative business advertised around the time of the South Sea Bubble of 1720, a phrase which equally applies to the Special Purpose Acquisition Companies (SPACs) that hit maximum popularity in early 2021.

You put your money into an empty vessel and hope that the named backer finds a private company to take public through purchase. Why wouldn’t you want to put your money into an unknown business that has A-Rod, Sammy Hagar, or Kevin Durant as its backer? Note: That’s both a rhetorical and a sarcastic question.

Caveat: SPAC investors typically get an option to request their money back once an acquisition target gets announced. So, it’s a bit like a free option for the original SPAC backers.

NFTs

Have people entirely lost their minds? You bought a digital thing and you value it highly because there can only be one copy (or a limited number of copies) of the digital thing? And this is worth $1 thousand or $1 million, or $50 million to you?

Caveat: Art collecting is always insane when viewed from a finance perspective. Probably best to just leave it to aesthetics and the phrase “There is no accounting for taste.”

Tesla

There are only so many times I can point out how stupid this stock has been in the past, is now in the present, and always will be in the future, for ever and ever, amen. And at each point in time, I have not only been proven wrong, but proven colossally wrong. Like, it’s the wrongest stock-picking call anyone has ever made in the history of making wrong market calls. I feel really great as Tesla shares have zoomed from a ridiculous $100 billion valuation to a ludicrous-mode $1 trillion market capitalization in less than 2 years. But still: Y’all are crazy. I feel extraordinary conviction on this.

Caveat: I understand the cars are great. I have no problem with the cars. Just the stock, and its price. And it’s bizarre owner, Elon Musk. Him I have a problem with. But again, I’m the idiot, I admit that.

The most common ending to human delusions, financial and religious, is heartbreak. In finance, however, some bubbles serve the purpose of creating the conditions for future economic innovation. After the wreckage of a burst bubble, we can often see in retrospect how the creative destruction was necessary, or at least that it seeded new growth. This will be useful to remember, when the current crazy ends in tears.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts:

All Bankers Anonymous Book Reviews in one place

Book Review: The Four Pillars of Investing, by William Bernstein

What If You Back The Wrong SPAC?

Post read (831) times.