I just made one of the neatest investments of my life and I’m dying to tell you about it.

The Royalty Exchange runs regular online auctions – a few every week – that allow investors to purchase future music royalty payments. Most auctions give the winner the rights to 10 years of future payments, while a few offer payments for the full artist’s lifetime, plus 70 years after that.

In my brief time watching auctions on Royalty Exchange, it seems that big-name artists attract a premium price for their royalties, in other words a larger “multiple” of last year’s earnings. Just in the past month the site has facilitated sales of royalties for pop and hip-hop artists like Cardi B, Dr. Dre, Wiz Khalifa and Drake. In prior years they’ve facilitated sales of royalties for classic bands like Earth, Wind & Fire, Dire Straits, and The Grateful Dead. I haven’t noticed any screamingly cheap auctions. Like any auction process, the price sometimes starts low and then ends up head-scratchingly high.

To be perfectly clear: Investments like this are not exactly advisable. My fun investment I want to tell you about violates all sorts of advice that I like to give other people about how to invest their money. You should probably do the boring, basic, correct thing for building long-term wealth. (Which, as I periodically remind everyone who will listen, is: Buy 100% low-cost diversified equity funds, and never, ever, sell).

But still, I’ll admit I’m fired up about this relatively new asset class. I feel like I just went on an awesome first date. It’s exciting! Like, hey I just met you, and this is crazy, but here’s my number so call me, maybe?

Some Royalty Exchange auctions are for future payments on a single song. Others for an album’s worth of songs, and still others for whole extensive back catalogues by multiple artists. Royalties derive from album sales, radio play, online streaming or TV and movie rights, or any combination of these, depending on the individual auction terms.

What many Texans around here know – from proximity to the oil and gas extraction business – is that long-term royalties offer diversification from traditional stocks, bonds, and mutual funds.

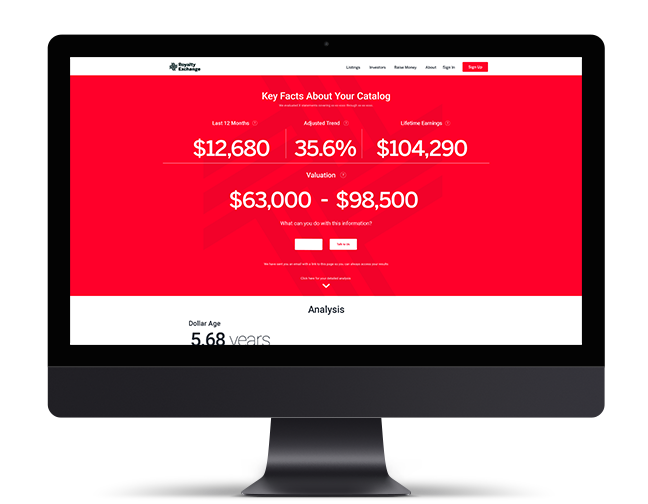

Royalty Exchange’s website provides an impressive amount of data on each listing for sale – like historic earnings, how much and for how long have they been paid, and easy-to-read pie graphs on where revenue comes from.

My Investment

I purchased 10 years’ worth of song royalties from a list that went up for sale in early June of 134 European-produced songs, “a diverse collection of soul, funk, jazz-fusion and dance music,” according to the Royalty Exchange website.

Had I heard of any of the songs or the artists on the list I bought? Well, um, no.

To be perfectly frank, I bought based on a track record of the last 2.5 years’ cash flows, and trusting in the theory of diversification. Five songs on the list made up half of last year’s earnings. I paid just over three times the previous year’s royalties. If payments drop off a lot over the next ten years, I’ll lose money. If they stay steady for the next decade, it will be a fine investment. If for some unknowable and unexpected reason one of the obscure songs on my list gets picked up for the Game of Thrones prequel series, I’ll be a randomly happy amateurish lucky investor. (psst: George R.R. Martin – give me a call.)

As an investor, I like that the performance of my European “soul, funk, jazz-fusion and dance” song catalogue will likely not correlate with other investments I own, like stocks that respond to interest rates, earnings and economic trends, or like my house, which responds to local real estate trends.

Royalty Exchange’s mission, however, is broader than just offering a portfolio diversifier to people like me. They want to unlock the previously closed and opaque world of royalty sales. PJ Miklus, Vice President and head of investor relations, told me, “We’re trying to create a whole transparent marketplace that has full price discovery.” One way they help is by providing an app to songwriters, producers and artists called “Know Your Worth” as a way to encourage royalty holders to consider selling.

Zillow, for music royalties

The app, says Miklus, “is like the Kelly Blue Book, it gives a first analysis of what your royalties could be worth.” Another analogy would be Zillow, but if you could choose to sell 10% of your house for just the next 10 years.

The exchange makes money by charging 15% of net proceeds to sellers, as well as $500 to buyers to handle payment administration. They are growing tremendously quickly. The Exchange raised $8.8 million in 2017, $20 million in 2018, and $7.5 million in just the first quarter of 2019 alone.

Goldman Sachs recently reported on the massive uptick in streaming music sales buoying the industry, which had been in a slump as recently as 2014. Music revenue, they predict, will double by 2030. Paid streaming subscribers on platforms Apple Music and Spotify, for example, doubled between 2016 and 2018.

Since current management took over Royalty Exchange in 2015, they have completed over 650 sales with a total raised for rights holders of $60 million. Miklus estimates $2.5 billion in annual royalty payments flow through the two largest US royalty payment groups BMI and ASCAP. If Royalty Exchange handled sales of just 1% of that, they could sell $25 million in annual royalties. At an estimated 5 times multiple of annual payments, they could raise $125 million for royalty holders per year.

Although 95% of Royalty Exchange transactions are for music royalties, they have facilitated sales of book and photography royalties, as well as movie residuals. Miklus says he expects music royalties to remain the focus of the company in the future.

I won’t know for a few years the actual success or failure of my foray into music royalty investing, but based on my excitement I think my “soul, funk, jazz-fusion and dance music” investment won’t be my last.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Post read (2158) times.

One Reply to “Favorite New Investment: Music Royalties!”